Unlocking deep financial insights can transform your business decisions. Financial Fusion promises to do just that.

In this post, we will review the Financial Fusion Lifetime Deal, an AI-powered tool designed for intuitive financial insights and streamlined data management. Whether you’re a small business owner or a consultant, understanding your finances is crucial. Financial Fusion integrates with popular accounting tools like QuickBooks and Xero to offer real-time updates and customizable reporting. With features aimed at enhancing decision-making and saving time, this tool could be the game-changer you need. So, let’s dive into what makes Financial Fusion worth considering for your financial management needs. Click here to explore the Financial Fusion Lifetime Deal.

Introduction To Financial Fusion

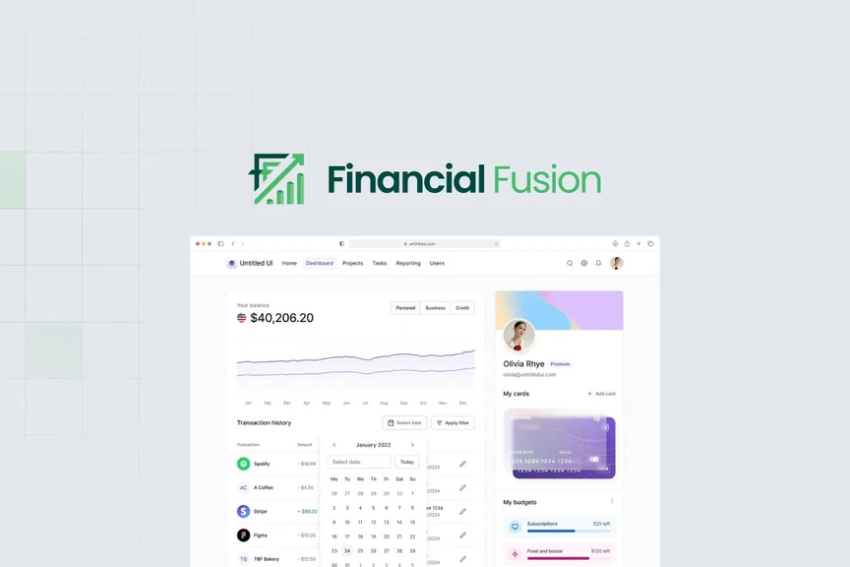

Financial Fusion is a powerful AI-driven tool aimed at transforming financial data management. It integrates seamlessly with popular accounting tools, making financial decision-making more intuitive and streamlined.

Overview Of Financial Fusion

Financial Fusion provides AI-powered financial insights that are designed to help businesses make smarter decisions. It offers real-time updates, customizable reports, and smooth integration with tools like QuickBooks, Xero, Zoho, and Excel. This allows businesses to gain deeper financial clarity, visualize trends, and save time by connecting all data sources.

| Feature | Description |

|---|---|

| AI-powered insights | Provides smarter decision-making capabilities |

| Real-time updates | Enhances decision-making with current data |

| Customizable reporting | Tailors reports to business needs |

| Seamless integration | Works with QuickBooks, Xero, Zoho, Excel |

Purpose And Target Audience

The primary purpose of Financial Fusion is to streamline financial data management and provide intuitive insights for better decision-making. This tool is particularly beneficial for:

- C-suite executives seeking precise financial analytics.

- Consultants needing to visualize financial trends quickly.

- Small businesses looking to save time and maintain smooth workflows.

With its affordable pricing tiers, Financial Fusion offers a range of options for businesses of different sizes:

- License Tier 1: $29 – Includes all features for 1 company, lite reports.

- License Tier 2: $99 – Adds detailed reports, balance sheets, reviews.

- License Tier 3: $199 – Supports up to 5 companies, detailed reports, reviews.

The tool also guarantees a 60-day money-back refund policy, ensuring risk-free investment. Financial Fusion stands as a practical alternative to more expensive tools like Tableau, offering lifetime access and continuous updates.

Credit: lifetimo.com

Key Features Of Financial Fusion

Financial Fusion provides powerful tools to manage your finances efficiently. Its main features enhance decision-making and streamline data management. Below, we explore the key features in detail.

Comprehensive Financial Planning Tools

Financial Fusion offers comprehensive financial planning tools. These tools allow you to create detailed plans for your financial future. You can set goals, track progress, and adjust strategies as needed. This feature ensures you stay on the right path to achieve financial stability.

Automated Budget Tracking

With automated budget tracking, Financial Fusion simplifies the budgeting process. It automatically monitors your income and expenses. This helps you maintain a balanced budget without manual calculations. The real-time updates keep you informed about your financial status.

Investment Portfolio Management

Investment portfolio management is another standout feature. Financial Fusion helps you manage your investments effectively. You can view your portfolio, track performance, and make informed decisions. This feature ensures your investments are aligned with your financial goals.

Real-time Financial Insights

Financial Fusion provides real-time financial insights. These insights are powered by AI and help you make smarter decisions. You can visualize trends and understand your financial health at a glance. The real-time updates keep your financial data current and accurate.

Secure Data Encryption

Secure data encryption ensures your financial information is safe. Financial Fusion uses advanced encryption methods to protect your data. This security feature guarantees that your sensitive information remains confidential. You can have peace of mind knowing your data is secure.

| Feature | Description |

|---|---|

| Comprehensive Financial Planning Tools | Create detailed financial plans and track progress. |

| Automated Budget Tracking | Automatically monitor income and expenses. |

| Investment Portfolio Management | Manage investments and track performance. |

| Real-Time Financial Insights | AI-powered insights for smarter decisions. |

| Secure Data Encryption | Advanced encryption methods to protect data. |

Pricing And Affordability

Financial Fusion offers a compelling lifetime deal that provides significant savings compared to regular subscription models. Let’s dive into the details of the pricing structure and evaluate its affordability.

Breakdown Of Lifetime Deal Cost

The lifetime deal of Financial Fusion is available in three different license tiers, each designed to cater to different business needs.

| License Tier | One-Time Purchase | Original Price | Features |

|---|---|---|---|

| License Tier 1 | $29 | $490 |

|

| License Tier 2 | $99 | $980 |

|

| License Tier 3 | $199 | $1,470 |

|

Comparison With Regular Subscription Models

Comparing these one-time payments to regular subscription costs reveals significant savings. Typically, a similar AI-powered financial tool can cost hundreds of dollars per year. Financial Fusion’s lifetime deal eliminates recurring payments, offering a more cost-effective solution.

- License Tier 1: Save $461 compared to annual subscriptions.

- License Tier 2: Save $881 compared to annual subscriptions.

- License Tier 3: Save $1,271 compared to annual subscriptions.

Value For Money Analysis

The value proposition of Financial Fusion is clear. For a one-time payment, users gain lifetime access to a powerful financial tool. The features include:

- AI-powered financial insights

- Real-time updates

- Customizable reporting

- Seamless integration with popular accounting tools

Considering the extensive features and the significant savings, Financial Fusion offers excellent value for money.

Financial Fusion is a smart choice for businesses seeking to enhance financial decision-making without the burden of ongoing costs.

Credit: m.facebook.com

Pros And Cons Based On Real-world Usage

In this section, we will explore the pros and cons of using Financial Fusion based on real-world usage. This will help you make an informed decision about whether this AI-powered financial tool fits your needs.

Advantages Of Using Financial Fusion

Financial Fusion offers several advantages that make it a valuable tool for businesses:

- AI-Powered Insights: Gain deeper financial clarity with precision-driven analytics.

- Real-Time Updates: Make decisions faster with up-to-date financial data.

- Customizable Reporting: Tailor your business stories with detailed and customizable reports.

- Seamless Integration: Integrates smoothly with tools like QuickBooks, Xero, Zoho, and Excel, ensuring a streamlined workflow.

- Cost-Effective: One-time purchase options starting at $29, which is a significant saving compared to the original prices.

- Flexible Licensing: Options to upgrade or downgrade between 5 license tiers.

- Generous Refund Policy: 60-day money-back guarantee.

Limitations And Areas For Improvement

While Financial Fusion is beneficial, there are some areas that could be improved:

- Integration Limitations: Although it integrates with popular tools, some niche accounting software may not be supported.

- Learning Curve: The AI-powered insights can be complex for users not familiar with advanced financial analytics.

- Limited Companies on Lower Tiers: License Tier 1 only supports one company, which might not be suitable for growing businesses.

By understanding both the advantages and limitations of Financial Fusion, you can better assess its fit for your accounting needs.

Specific Recommendations

Financial Fusion is an AI-powered tool that offers in-depth financial insights and seamless data management. It integrates with popular accounting tools to improve decision-making and reporting. Here are some specific recommendations on who should use Financial Fusion and scenarios where it excels.

Ideal Users For Financial Fusion

Financial Fusion is perfect for various users due to its comprehensive features and benefits. Here are the ideal users:

- C-suite executives: They need precise financial analytics for strategic decisions.

- Consultants: They can benefit from detailed reporting to advise clients better.

- Small businesses: They can save time and gain deeper financial clarity.

Scenarios Where Financial Fusion Excels

Financial Fusion is especially useful in specific scenarios. Here are some examples:

- Real-time updates: Businesses needing up-to-date financial insights for prompt decisions.

- Customizable reporting: Companies requiring tailored financial reports to tell their business story.

- Seamless integration: Organizations using multiple accounting tools like QuickBooks, Xero, Zoho, and Excel.

Additionally, Financial Fusion offers a variety of pricing tiers to suit different business needs:

| License Tier | Pricing | Features |

|---|---|---|

| License Tier 1 | $29 (originally $490) |

|

| License Tier 2 | $99 (originally $980) |

|

| License Tier 3 | $199 (originally $1,470) |

|

The tool also supports seamless integration with platforms like Airtable, Excel, QuickBooks, Shopify, and Xero. This makes it a versatile choice for many businesses.

Credit: bestsaasdeal.com

Frequently Asked Questions

What Is Financial Fusion Lifetime Deal?

The Financial Fusion Lifetime Deal offers users lifetime access to financial management tools. It includes budgeting, reporting, and analytics features. This deal is cost-effective and convenient.

How Does Financial Fusion Work?

Financial Fusion consolidates financial data into a single platform. Users can track expenses, manage budgets, and generate reports. It simplifies financial management and enhances productivity.

Is Financial Fusion Worth It?

Yes, Financial Fusion is worth it. It provides comprehensive financial tools at a one-time cost. Users save money and time.

Can I Integrate Financial Fusion With Other Tools?

Yes, Financial Fusion integrates with various financial tools and software. It enhances functionality and streamlines financial processes. Check compatibility on their website.

Conclusion

Financial Fusion is a valuable tool for managing financial data. Its AI-powered insights and seamless integration make financial tasks easier. This lifetime deal offers excellent value at a one-time price. Users can gain clear financial insights and save time. Whether for small businesses or consultants, Financial Fusion simplifies financial management. Check out Financial Fusion here and streamline your financial processes today.